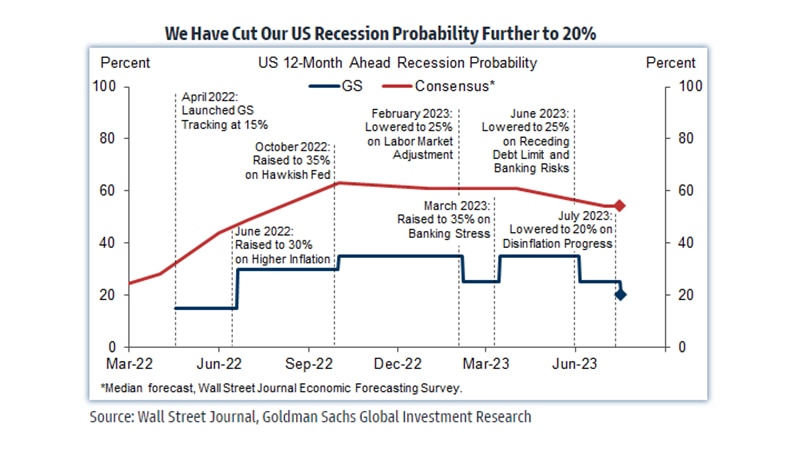

The probability of US recession in the next year has fallen to 20%

The probability of a U.S. recession in the coming year has declined, as recent economic data signal that bringing inflation down to an acceptable level will not require a downturn, according to Goldman Sachs Research.

Our economists say there’s a 20% chance of recession in the next 12 months, down from their projection of 25%. That’s still slightly above the unconditional average post-war probability of 15% — a recession has occurred approximately every seven years — but far below the 54% median among forecasters in the latest Wall Street Journal survey (which is down from 61% three months ago).

U.S. economic activity remains resilient, Jan Hatzius, head of Goldman Sachs Research and the firm’s chief economist, writes in the team’s report. Data suggest GDP is tracking to have increased 2.3% in the second quarter. And meanwhile consumer sentiment is rebounding sharply from depressed levels, unemployment fell back to 3.56% in June, and initial jobless claims are reversing their most recent mini-spike. Growth is expected to decelerate somewhat in the coming quarters, mostly because of slower growth in disposable income (especially when adjusted for the resumption of student debt payments) and a drag from reduced bank lending.

But even so, the easing in financial conditions, the rebound in the housing market, and the ongoing boom in factory building all suggest that the U.S. economy will continue to grow, albeit at a below-trend pace, Hatzius writes.

The inflation data have been encouraging. The 0.16% increase in the CPI (excluding food and energy) in June was the lowest since February 2021 and follows a string of 0.4% readings this year. That’s not just one month of better news — measures of underlying inflation such as trimmed-mean CPI and PCE have been easing for quite a while.

Moreover, there are strong fundamental reasons to expect ongoing disinflation, Hatzius writes. Used car prices are sliding amid higher auto production and inventories, rent inflation still has a long way to fall before it catches up with the message from median asking rents, and the labor market has continued to rebalance with an ongoing downtrend in job openings, quits, reported labor shortages, and nominal wage growth.

At the same time, our economists aren’t as concerned as some about the inverted yield curve in the U.S. Conceptually, an inverted curve means the rates market is pricing future cuts that are large enough to outweigh the term premium (investors typically require more compensation to hold a bond for a longer period of time). In the past, this has generally only happened in situations when a recession was becoming clearly visible — hence the curve’s strong track record as a recession predictor.

But three things are different about the current cycle, Hatzius writes. First, the term premium is well below its long-term average, so it takes fewer expected rate cuts to invert the curve. Second, there is a plausible path to Federal Reserve easing just on the back of lower inflation (both Goldman Sachs Research and the Federal Open Market Committee's non-recession projections call for more than 200 basis points of gradual cuts in the next 2-3 years). Third, if forecasters are overly pessimistic now, rates market investors — and thus the expectations priced into the yield curve — are probably also overly pessimistic. “The argument that the inverted curve validates the consensus forecast of a recession is circular, to say the least,” Hatzius writes.

With this in mind, the Fed is almost certain to hike interest rates by 25 basis points to 5.25-5.5% at the July 25-26 meeting, according to Goldman Sachs Research. But our economists expect it to be the last of the cycle.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.