|

|

|

|

|

|

|

| Goldman Sachs Asset Management |

| Overview |

|

|

|

Since its founding in 1869, Goldman Sachs, & Co. has played a key role in shaping many of the world’s defining moments for companies and institutions, markets and industries — while forming long-term client relationships based on integrity and innovation.

Today, continuing the firm’s tradition of excellence, Goldman Sachs Asset Management (GSAM) serves the investment management needs of preeminent institutions and individual investors worldwide through institutional strategies, mutual funds and subadvised portfolios. With more than $735 billion in assets under management across geographic borders, investment styles, and asset classes, GSAM ranks among the top 15 asset management firms globally1. GSAM also ranks in the top three institutional money market managers globally,2 offering taxable and tax-advantaged, on shore and offshore, and US$, Euro, Sterling and Yen denominated money market portfolios.

|

|

| The Goldman Sachs Advantage |

|

| |

|

GLOBAL RESEARCH EXCELLENCE |

We believe the key driver of long-term investment performance is superior research.

More than 250 GSAM research professionals average more than 8,000 annual research visits, generating high-quality, proprietary, buy-side research to form the basis of decision-making in our fundamental equity investment portfolios.

|

|

| |

|

DISCIPLINED INVESTMENT PROCESSES |

Team-Driven: In our experience, the process of considering many perspectives and then making consensus decisions may potentially reduce portfolio risk while supporting consistent investment results relative to benchmarks.

Research-Intensive: In many cases, portfolio managers for GSAM's fundamental strategies are also research analysts, creating a tight link between research and decision-making. On the quantitative side, our team uses fundamentally-based criteria to help focus the investment effort within broad equity universes.

Risk-Managed: Ongoing risk management is performed by each portfolio management team, while independent monitoring is executed by GSAM's Risk Management and Analysis Group. At GSAM, risk management means world-class quality management that seeks to generate, not constrain, alpha3.

Goal: High-quality portfolios that aim for strong, consistent investment results.

|

|

| |

|

WORLD-CLASS TALENT |

Industry-wide, many asset managers offer just one or two mutual fund investment strategies and professionals within different disciplines tend to operate independently of one another. In contrast, GSAM offers breadth and depth of expertise across 10 independent, specialist portfolio management teams while collaborating on a global scale to seek the best results for clients.

Portfolio Management Team Designations |

| Number of MBAs |

152 |

| Number of CFAs |

108 |

| Number of PhDs |

35 |

| CIO Industry Experience |

20 years (average) |

| As of September 30, 2007 |

|

|

|

| |

|

|

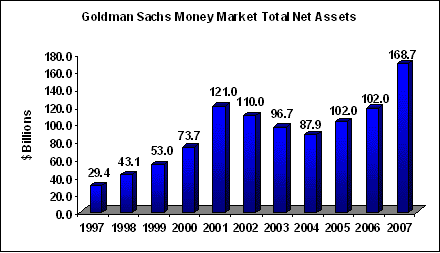

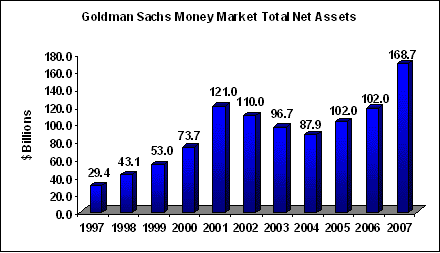

A Strong Money Market Fund Heritage |

|

At GSAM, money market fund management has been a core capability since 1981. Our $737 billion in assets under management as of 9/30/07 includes nearly $170 billion in money market fund assets, and GSAM is one of the largest providers of institutional money market funds.

|

|

This chart represents the growth of GSAM's total net assets in Money Market Funds and products4, including but not limited to the Goldman Sachs Financial Square FundsSM offered at this site.

An investment in a money market fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any government agency. Although a money market fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund.

|

| |

|

Primary Investment Objectives |

|

Goldman Sachs money market funds have three main goals: to maintain

stability of principal, to provide daily liquidity, and to maximize investment yield.

|

|

| Strict credit analysis |

The Goldman, Sachs & Co. Credit Department, consisting of over 250 credit analysts worldwide, provides an independently researched, "approved" list of securities to our money market portfolio management teams.5

|

| Active interest rate risk management |

Our portfolio management teams establish and periodically adjust weighted average maturity targets, implement and periodically adjust portfolio structures and provide rigorous analysis for new securities.

|

|

|

|

|

| Careful monitoring of liquidity factors |

These factors include consideration of liquidity needs as well as technical and economic influences that may lead to periods of increased asset volatility.

|

| Active portfolio management |

Active structuring of portfolios based on the short-term yield curve, our short-term interest rate outlook, and expected daily asset volatility.

|

|

|

|

|

| Pursuing attractive investment opportunities while focusing on quality |

We seek to leverage the vast resources of Goldman, Sachs & Co., including economists and credit research analysts, to better identify relative value trading opportunities.

|

| Maximizing investment yield while maintaining a risk-managed environment |

Active portfolio management allows us to seek competitive returns while offering investors the rigorous risk management they have come to expect from an industry leader.

|

|

|

|

|

|