Goldman Sachs Reports 2023 Second Quarter Earnings Per Common Share of $3.08 and Annualized Return on Common Equity of 4.0%

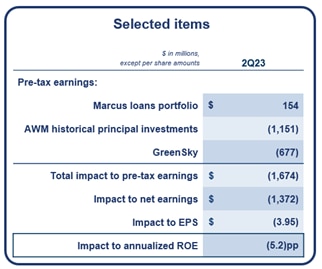

Selected Items Reduced Earnings Per Common Share by $3.95 and Annualized Return on Common Equity by 5.2 Percentage Points

NEW YORK, July 19, 2023 – The Goldman Sachs Group, Inc. (NYSE: GS) today reported net revenues of $10.90 billion and net earnings of $1.22 billion for the second quarter ended June 30, 2023. Diluted earnings per common share (EPS) was $3.08 for the second quarter of 2023 and annualized return on average common shareholders’ equity (ROE) was 4.0% for the second quarter of 2023.

Please view printable versions of the Second Quarter 2023 Earnings Results [PDF] and the Second Quarter 2023 Earnings Results Presentation [PDF].

Results for the second quarter of 2023 were impacted by selected items related to the execution of strategic goals as outlined at Investor Day – in particular, the narrowing of consumer ambitions and the transition of the Asset & Wealth Management business to a less capital-intensive model.

Specifically, the selected items that the firm has sold, or is selling, or for which the firm has announced the exploration of a sale are:

- A gain of approximately $100 million in connection with our sale process for the Marcus unsecured loan portfolio, as well as the business’ operating results;

- Losses from historical principal investments within Asset & Wealth Management (legacy investments the firm intends to exit over the medium term, a 3-5 year time horizon from year-end 2022); and

- Results relating to GreenSky, including an impairment of goodwill of $504 million related to Consumer platforms.

In aggregate, for the second quarter, the impact of these three items reduced net earnings by $1.4 billion, EPS by $3.95 and annualized ROE by 5.2 percentage points. The impact to net earnings reflects the effective tax rate for the second quarter of 2023 for the respective segment of each selected item.

David Solomon, Chairman and CEO of Goldman Sachs, said, “This quarter reflects continued strategic execution of our goals. Global Banking & Markets delivered solid returns in an environment with cyclically low activity levels and we remained #1 in completed M&A – a testament to our world-class client franchise. Asset & Wealth Management produced record AUS, record Management and other fees and record net revenues in Private banking and lending. I remain fully confident that continued execution will enable us to deliver on our through-the-cycle return targets and create significant value for shareholders.”

A conference call to discuss the firm’s financial results, outlook and related matters will be held at 9:30 am (ET) on the date noted above. The call will be open to the public.

Members of the public who would like to listen to the conference call should dial +1-888-205-6786 (in the U.S.) and +1-323-794-2558 (outside the U.S.) passcode number 7042022. The number should be dialed at least 10 minutes prior to the start of the conference call. The conference call will also be accessible as an audio webcast through the Investor Relations section of our website, www.goldmansachs.com/investor-relations. There is no charge to access the call. For those unable to listen to the live broadcast, a replay will be available on our website beginning approximately three hours after the event.

Please direct any questions regarding obtaining access to the conference call to Goldman Sachs Investor Relations, via e-mail, at gs-investor-relations@gs.com.